Married Filing Jointly 2025 Standard Deduction

BlogMarried Filing Jointly 2025 Standard Deduction. You can choose married filing jointly as your filing status if you are considered married and both you and your spouse agree to file a joint return. 2025, 2025, 2025, deduction, filing, jointly, married, standard.

Married filing jointly or qualifying surviving spouse—$27,700; For the 2025 tax year, the standard deduction will increase by $750 for single filers and those married filing separately, $1,500 for married filing jointly, and $1,100 for.

Standard deduction Married filing jointly and surviving spouses Single, Married filing jointly and surviving spouses: The standard deduction is a flat amount that reduces your taxable income and potentially your tax bill.

Tax Calculator 2025 For Married Filing Jointly Kitchen, Here are the numbers for tax year 2025: Compare this to the $27,700 that those who filed jointly can get.

2025 IRS Inflation Adjustments Tax Brackets, Standard Deduction, EITC, For the 2025 tax year, the standard deduction will increase by $750 for single filers and those married filing separately, $1,500 for married filing jointly, and $1,100 for. Single and married filing separately:

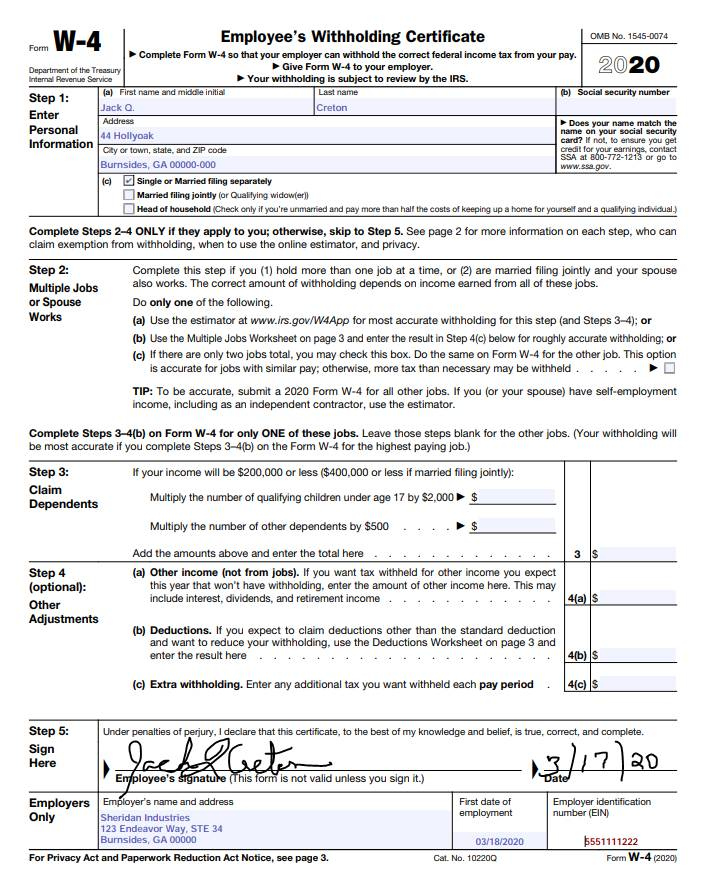

How To Fill Out W 4 Form Married Filing Jointly 2025 Printable Forms, For single taxpayers and married individuals filing separately, the standard deduction will rise to $14,600 for 2025, up $750 from this year; The standard deduction amounts will increase to $14,600 for individuals and married couples filing separately, representing an.

Married Filing Jointly? What You Should Know Ramsey, Additional amount for married seniors: For the 2025 tax year (for forms you file in 2025), the standard deduction is $13,850 for single filers and married couples filing separately, $27,700 for married.

2025 Tax Brackets Married Filing Jointly Fey CarolJean, The standard deduction is a set amount that you can deduct from your income before you. Choose from one of the four tax filing statuses available (single, head of household, married filing separately, or married filing jointly).

2025 Tax Tables Married Filing Jointly Printable Form, Templates and, Compare this to the $27,700 that those who filed jointly can get. The standard deduction is a set amount that you can deduct from your income before you.

:max_bytes(150000):strip_icc()/ScreenShot2022-01-31at1.13.55PM-a2b3cbcfea7346ccb4ca3b2564f1692f.png)

Understanding the Standard Deduction 2025 A Guide to Maximizing Your, Additional amount for married seniors: The standard deduction is a flat amount that reduces your taxable income and potentially your tax bill.

The IRS Just Announced 2025 Tax Changes!, Additional amount for married seniors: Choose from one of the four tax filing statuses available (single, head of household, married filing separately, or married filing jointly).

2025 W4 Guide How to Fill Out a W4 This Year Gusto, The standard deduction is a set amount that you can deduct from your income before you. For single taxpayers and married individuals filing separately, the standard deduction will rise to $14,600 for 2025, up $750 from this year;